There’s a crucial number to keep in mind when creating a pitch deck: 2.5

That’s how many minutes the average VC spends reading your deck.

Not 10 minutes. Not even 5 minutes. Two and a half minutes.

And the conversion funnel? Out of every 100 decks that hit an investor's inbox:

- They'll take 20-30 calls

- Have a handful of serious conversations

- Extend 1-2 term sheets

Now add to that the AI era reality: VCs are seeing 5+ companies that sound almost identical every single day. "We're AI for CRM." "We're AI for accounting." "We're AI for [insert category here]."

So if your pitch isn't immediately clear, distinctive, and memorable, you've already lost.

What stories actually do (according to science, not fluff)

Okay, so why do I keep harping on story? Because the data is overwhelming:

Stories are 22x more memorable than facts alone.

And memorability isn't just a nice-to-have, it's mandatory. Here's why:

- First, you need the investor to remember your story. That investor is reading dozens of decks this week. At the end of the day, they need to remember yours. Not just vaguely recall it. Actually remember the core argument well enough to get excited about it again. You need to stand out clearly among the rest.

- Second, you need to give VCs a story they can sell to their colleagues. Even if an investor loves your company in the moment, they still need to sell it internally, to their partners, to their IC, to whoever controls the purse strings. If you haven't given them a clear, compelling story to retell, you're making their job harder. And investors won't do hard work for you.

Think about that game of telephone we all played as kids. With each person in the chain, the number of facts recalled drops by about half. But with stories? They not only survive multiple retellings, they actually strengthen over time. The gist becomes clearer and stickier with each retelling.

This isn't mystical. It's neuroscience. Stories light up more parts of the brain than facts do. They engage emotion. And emotion creates stronger memories.

Here's the thing investors won't tell you: they want to feel something. They want to be inspired. Excited. They want to believe. Yes, they'll make a logical, rational decision, they're fiduciaries, after all. But they're also human beings who need an emotional reason to care before they dig into your unit economics.

The common mistake is going with facts alone. The winning approach is story plus facts. Heart and head.

But what if you don't have time for story?

Remember those 2.5 minutes?

If you don't have a clear story, here's what happens:

- You're not memorable. The investor reads 10 more decks that day and yours blurs into the background.

- The investor can't sell you internally. Even if they like your company, they don't have a compelling narrative to bring to their partners or IC.

- Someone else tells your story for you – and you lose control of your own narrative.

If you do have a clear story, here's what happens:

- You make an immediate impact in those critical first 2.5 minutes.

- You give investors language to champion you internally.

- You differentiate yourself in a sea of sameness.

- You create the sense of inevitability, that of course this problem needs solving, of course you're the team to do it, of course this is going to work.

The story you need isn't a fairy tale

I'm not asking you to write a creative fiction piece. I'm asking you to make an argument.

A great fundraising pitch is an argument for why:

- This problem is urgent and massive

- This solution is inevitable

- This team is uniquely positioned to execute

- This moment is right now

That's it. That's the story.

And here's the thing about arguments: they have structure. They have frameworks. You don't need to be a creative genius to build one. You just need to be clear, strategic, and willing to put your best foot forward.

The mistakes I see most often? You're too close to your business. You know it so well that your brain automatically fills in gaps you don't realize you're leaving. You think you're being clear. You're not. You're too technical when investors need simplicity. You're too dense when they need clarity. You're burying your best material when it should lead.

Every author needs an editor. Every great film has a director and a producer. There are brilliant scenes on the cutting room floor that would have made the movie too long or illogical. The same is true for your pitch.

So what does this mean for your deck?

If your pitch isn't landing, it might not be that investors don't like your business. They might just not like your story. And that's fixable.

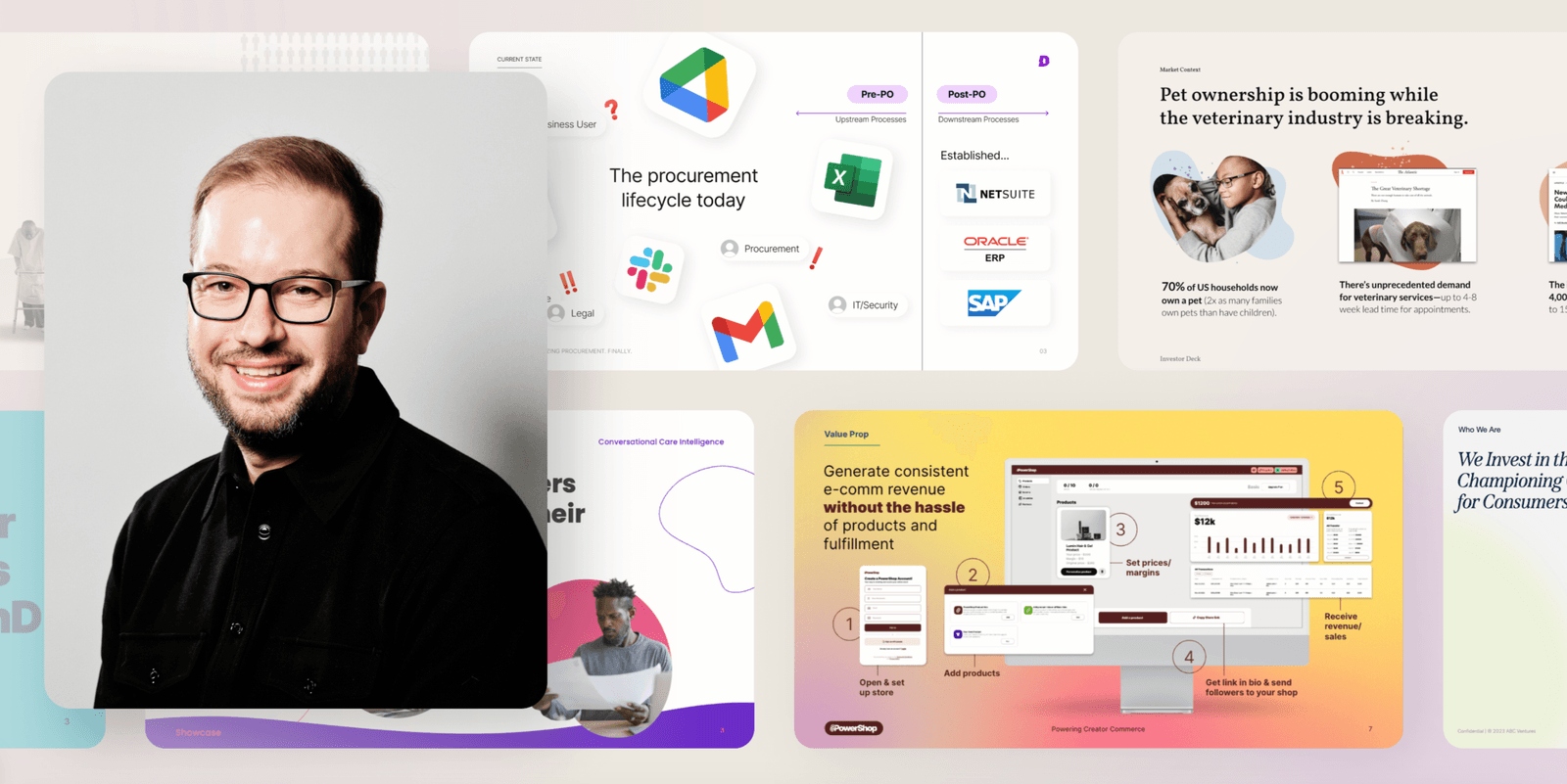

Most founders I work with have compelling traction, smart insight, legitimate technology, and real market opportunity. But their pitch doesn't work because they haven't done the hard work of distilling their strategy into a narrative that makes it easy for investors to see why they should bet on you.

Next time you pitch, don't just bombard investors with a list of facts. That's unlikely to work. But if you can weave those facts into a story beautifully and elegantly? You could be on to a winner.

Your job isn't just to build a great company. It's to make an airtight case for why your company deserves capital right now.

And that requires a story. Not fairy dust. Not fluff. Just brutal clarity about what you're building and why it matters.

Raising soon? Let's chat